EIG Global Energy Partners has sold to Fluxys Belgium a portion of South America's biggest natural gas pipeline, clearing a regulatory obstacle to buying a bigger share of the Brazil-Bolivia duct, EIG's CEO said on Tuesday.

U.S.-based EIG wants to bid for the 51% stake in the pipeline owned by Brazil's state-run oil company Petrobras, Chief Executive Blair Thomas told Reuters, as part of a wider move to into the country's growing natural gas industry.

He said antitrust issues blocking an EIG bid for a stake in Petrobras are settled by the sale for an undisclosed amount of EIG's 27.5% stake in the Brazilian part of a pipeline known as Gasbol, which connects Bolivian reserves to Brazil.

"This is about liberating us for a wider strategy," Thomas said in an interview via videoconference.

He said EIG, which manages funds focused on energy assets, aims to create a private-sector alternative for processing and transporting gas from oil majors as the country develops this century's largest offshore finds, known as the pre-salt.

EIG stands ready to spend billions to join partners in acquiring pipelines, processing plants and eventually production of natural gas in Brazil, Thomas said, as supply and demand for the fuel grows in Latin America's largest economy.

"We believe in the energy transition and natural gas has a key role to play in that," Thomas said.

EIG's bet in Brazil comes while Petroleo Brasileiro SA, as the state firm is known, speeds up asset sales, ending what was nearly a state-held monopoly in natural gas five years ago.

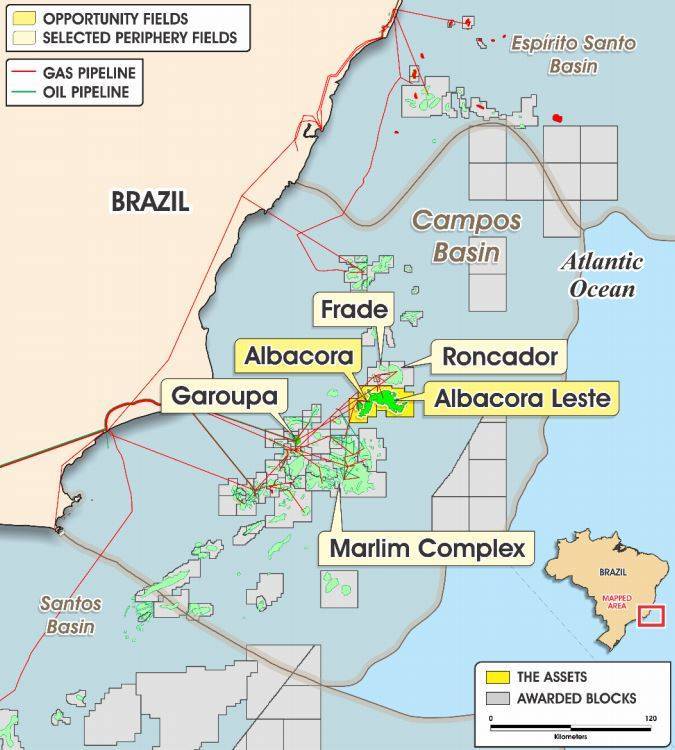

He said EIG is also looking into mid-life offshore oil fields from Petrobras producing from 150,000-200,000 barrels a day, including legacy fields Albacora and Marlim.

SHIFTING AWAY FROM BOLIVIA

Gasbol connects natural gas reserves in the Andean nation to Brazil via two separate entities: Gas TransBoliviano SA (GTB) which owns and runs the Bolivian section and Transportadora Brasileira Gasoduto Bolívia-Brasil SA (TBG), its counterpart for Brazil.

The EIG fund holding the Brazil-Bolivia pipeline investment will be closed, Thomas said. The Bolivian side of the 2,600-kilometer (1,600-mile) pipeline, in which EIG has a 38% stake, will eventually be sold too, he said, without giving details.

Brazil has been importing most of its natural gas from Bolivia in recent decades. But new oil and gas discoveries are slowly decreasing this dependence and may turn Brazil into a gas exporter someday, Thomas said.

Together with the cheap liquefied natural gas (LNG) imported by ships, Thomas said, the offshore finds are likely to feed a growing consumer market driven by industrial use.

On Monday, EIG-backed natural gas company GNA received its first imported LNG cargo in Brazil. The super-chilled fuel will be used in a power plant expected to start commercial operations in the first half of 2021.

Brazil will now be a regular importer of LNG, said Thomas, and in 10-15 years the country may be ready for its first export plant, another EIG investment target.

"We absolutely want to be first in that," he said.

(Reporting by Sabrina Valle and Gram Slattery Editing by Brad Haynes, Paul Simao, Grant McCool and David Gregorio)

No comments

Post a Comment